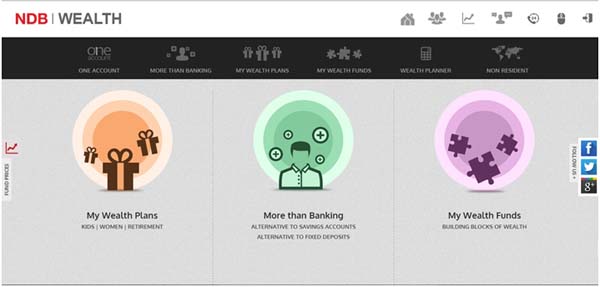

NDB Wealth re-launches website

With a state-of-the-art Wealth Planner Tool

Expert financial planner NDB Wealth has unveiled a new look and feel website, www.ndbwealth.com, in keeping with the recent re-launch of its portfolio of innovative savings products, which have been designed to offer the simplicity and convenience of a bank account but with much higher returns. Excitingly, www.ndbwealth.com also features a state-of-the-art Wealth Planner Tool, which facilitates potential customers in discovering the NDB Wealth savings products that best match their short- and/or long-term financial requirements.

The innovative NDB Wealth Planning Tool enables users to narrow down their choices to the best NDB Wealth savings products capable of catering to their unique lifestyles. It does this by using four fast and easy steps wherein potential customers are asked to state their preferences in terms of financial planning goals, risk profiles, choice of investment instruments and timeframes.

Additionally, www.ndbwealth.com also offers access to a number of key information resources for potential customers, from detailed descriptions of NDB Wealth products, to up-to-date performance indicators, and even current rates of returns and per-unit buying and selling prices. The website also provides online application and customer service capabilities, to further support new customers.

For existing customers, www.ndbwealth.com allows access to a web portal wherein one stays fully updated about account information and balances, following the completion of a highly secure sign in process.

Commenting, NDB Wealth CEO Prabodha Samarasekera noted, “Our new website is a fully functional platform for motivated individuals who want to make optimal use of their savings. It allows them to explore the numerous opportunities that only NDB Wealth can offer. For example, our state-of-the-art Wealth Planning Tool benefits users by giving them excellent insight into the best NDB Wealth savings product options to suit their needs, based on their individualised responses. This innovation is a good first step for potential customers to learn about what is on offer, with our expert financial planners also stepping in at a later stage to contribute more specialised knowledge and expertise.”