Ceylinco Life pays Rs 2.87 billion in claims & benefits to policyholders in Q1

Life insurance leader says inherent financial strength and stability equip Company to face challenges of post-COVID-19 revival

Life insurance leader says inherent financial strength and stability equip Company to face challenges of post-COVID-19 revival

Ceylinco Life has announced the payment of Rs 2.87 billion in gross benefits and claims to policyholders in the three months ending 31st March 2020, an increase of 17.7 per cent over the first quarter of 2019.

Unfazed by the projected adverse impacts of the COVID-19 pandemic, Sri Lanka’s life insurance market leader demonstrated its commitment to its core business by transferring Rs 1.81 to its Life Fund in respect of the first quarter of the year, taking the fund to Rs 98.12 billion as at 31st March 2020.

Healthy volume gains in core business and investments before the COVID-19 necessitated shutdown of businesses in mid-March, enabled Ceylinco Life to generate gross income of Rs 8.11 billion for the three months, with Gross Written Premium Income growing by 10.5 per cent to Rs 4.73 billion, and Investment and Other income increasing by a noteworthy 16.6 per cent to Rs 3.38 billion.

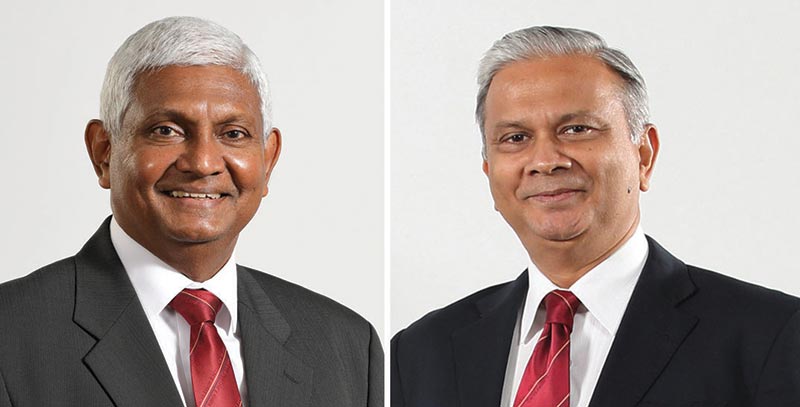

“This was a good start to a year that is going to be extremely challenging,” Ceylinco Life Chairman Mr R. Renganathan said. “What our first quarter performance does is underline the inherent strength and stability of Ceylinco Life and demonstrate the Company’s determination to face external challenges and overcome them. While every business sector is expected to be adversely affected by the shutdowns necessitated by the pandemic, businesses like Ceylinco Life which are fundamentally sound are better geared to weather the crisis.”

Ceylinco Life Managing Director Mr Thushara Ranasinghe said the Company’s unwavering focus on best practices in the sphere of life insurance as well as its strong and proven credentials in astute investment management underpin its financial strength and stability.

Ceylinco Life’s total assets grew by a respectable 12 per cent over the three months reviewed to Rs 149.6 billion as at 31st March 2020.

Ceylinco Life ended 2019 on a characteristically strong note as well, with consolidated income of Rs 32.1 billion for the 12 months ending 31st December 2019, reflecting top line growth of 9.9 per cent. The Company reported gross written premium income of Rs 18.7 billion, retaining its status as the market leader for life insurance in Sri Lanka for the 16th consecutive year.

Sri Lanka’s leading life insurer for 16 of the 32 years it has been in existence, Ceylinco Life was declared the ‘Peoples Life Insurance Service Provider of the Year’ for the 14th consecutive year at the 2020 SLIM-Nielsen Peoples Awards, and was also adjudged Sri Lanka’s most valuable life insurance brand by Brand Finance in 2019. The Company was also ranked among the 10 ‘Most Admired Companies’ in the country by the ICCSL in 2019 and in the same year was named the Best Life Insurer in Sri Lanka for the sixth consecutive year by World Finance, and ranked sixth overall in the Business Today ranking of the country’s top 30 companies.

Ceylinco Life has close to a million lives covered by active policies and is acknowledged as a benchmark in the local insurance industry for innovation, product research and development, customer service, professional development and corporate social responsibility.