ComBank makes steady start to 2020 with pre-COVID-19 gains

- Impairment charges for Q1 surge to Rs 6.54 bn.

- Deposits grew by Rs 51.33 bn. to Rs 1.10 Tn.

- Advances grew by Rs. 28.74 bn. to Rs. 949.2 bn.

Healthy growth in business volumes and an extraordinary contribution from other income, before the slowdown attributed to the COVID-19 pandemic, have enabled the Commercial Bank of Ceylon PLC to make a steady start to 2020, despite the continuing increase in impairment charges quarter-on-quarter.

Sri Lanka’s benchmark private sector bank has reported a gross income of Rs 39.444 billion for the three months ending 31st March 2020, recording a growth of 12.87%. Interest income growth remained predictably flat, up just 0.83% to Rs 31.892 billion, but the Bank’s interest expenses, at Rs 19.466 billion, reflected an achievement of a 1.43% reduction during the quarter reviewed, attributable to timely re-pricing of liabilities as well as an improvement in its CASA ratio. This enabled the Bank to generate net interest income of Rs 12.426 billion, an improvement of 4.59%.

A 4.34% depreciation of the Sri Lanka Rupee against the US Dollar in the three months reviewed as against an appreciation of 4.27% recorded in the first quarter of 2019, coupled with a revaluation of the Bank’s foreign currency assets and liabilities, resulted in the Bank posting an exchange profit of Rs 6.514 billion, which helped convert a net loss of Rs 389.309 million in other operating income in Q1 2019 to net income of Rs 6.587 billion in the three months under review. At the same time, a loss of Rs 2.348 billion was recorded from trading in the quarter reviewed due to unrealised losses on forward foreign exchange contracts entered into by the Bank. Consequently, the Bank’s total other income grew ten-fold from Rs 460 million reported for the first quarter of 2019 to Rs 4.600 billion for the quarter under review.

The continuing necessity to make substantially higher provisions for impairment charges in response to the trend common to the industry of increasing NPLs, saw the Bank making a provision of Rs 6.545 billion in respect of the reviewed quarter. In the preceding three quarters, the Bank made provisions of Rs 2.738 billion, Rs 2.956 billion and Rs 3.515 billion, respectively for impairment charges and other losses.

As a result of the higher impairment charges, the Bank’s net operating income declined by a marginal 0.38% to Rs 12.775 billion, despite the fact that total operating income had grown by a robust 31.64% to Rs 19.320 billion.

Continuous focus on containing controllable expenditure enabled the Bank to keep total expenditure for the three months to Rs 6.536 billion, an increase of mere Rs 254 million or 4.04% over the corresponding quarter of last year.

Operating profit before taxes at Rs 6.239 billion reflected a decline of 4.63%, but with taxes on financial services reducing by 42.83% to Rs 1.010 billion for the quarter under review due to the abolition of Nation Building Tax (NBT) from December 2019 and Debt Repayment Levy (DRL) from January 2020, the Bank posted a profit before income tax of Rs 5.229 billion for the three months, an increase of 9.51%.

Profit after tax grew by 22.62% to Rs 3.707 billion, with the increase in the tax-exempt component of income being higher in the reviewed quarter in comparison with Q1 of 2019.

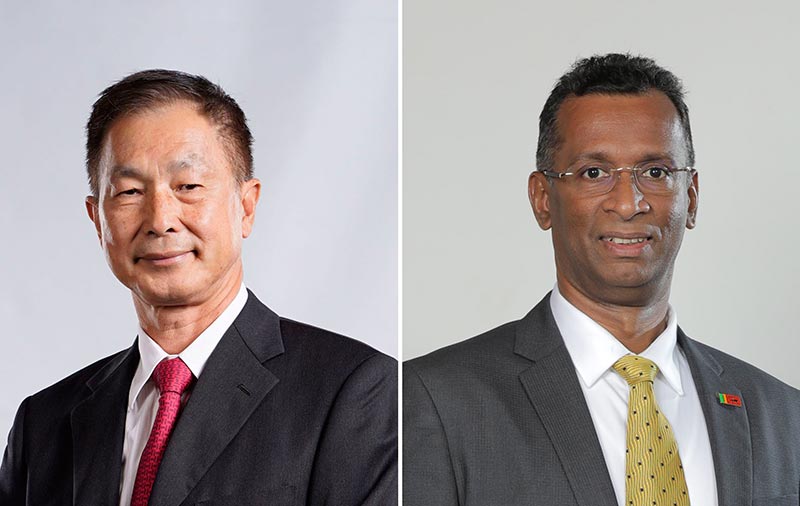

Commenting on the Bank’s performance in the quarter reviewed, Commercial Bank Chairman Mr Dharma Dheerasinghe said: “Although the impact of the shutdown of businesses necessitated by the COVID-19 pandemic is not yet reflected in the top line performance of the Bank because we had relatively normal volumes up to the middle of March, we did witness a continuing worsening in the prospects for certain business sectors. As a result, provisioning for impairment charges during a single quarter reached an all-time high in this quarter, and will add to the burden of the Bank in the post-COVID-19 recovery period.”

The Bank’s Managing Director Mr S. Renganathan disclosed that the Bank had increased its CASA ratio to 39.81% from 37.10% at the end of last year, even as it recorded extremely healthy deposit mobilisation in the reviewed three months. The Bank is currently in the process of assessing the potential impacts of the COVID-19 pandemic on lending, he said, while conveying his appreciation to employees at all levels for their exemplary dedication to serve customers while facing various challenges during the pandemic-linked lockdown. “The Bank was able to adapt very quickly to provide customers safe and convenient access to services during the crisis through multiple channels,” Mr Renganathan said. “We did our best to minimise the impact of the lockdown on customers and are now geared to respond even better if needed, in the future.”

Total assets of the Bank increased by Rs 63.919 billion or 4.61% at a monthly average of Rs 21.3 billion to Rs 1.451 Trillion as at 31st March 2020. Asset growth over the preceding 12 months was Rs 132.665 billion or 10.06% YoY.

Gross loans and advances grew by Rs 28.744 billion or 3.12% since end 2019 to Rs 949.201 billion at the end of the three months under review. The growth of the loan book over the preceding year was Rs 64.562 billion reflecting YoY growth of 7.30%.

Total deposits recorded a growth of 4.87% or Rs 51.326 billion over the three months to reach Rs 1.105 Trillion as at 31st March 2020, reflecting average monthly growth of over Rs 17 billion. Deposit growth since 31st March 2019 was Rs 98.557 billion or 9.80% at a monthly average of Rs 8.2 billion.

In other key indicators, the Bank’s gross NPL ratio increased to 5.27% from 4.95% at end 2019 and 4.14% at end of first quarter 2019, while its net NPL ratio increased similarly to 3.24% from 3.0% at the start of the quarter. The net NPL ratio at the end of the corresponding quarter of 2019 was 2.47%.

The Bank’s Total Tier 1 capital ratio stood at 11.495% as at 31st March 2020, comfortably above the revised minimum requirement of 9% imposed by the regulator consequent to the COVID-19 pandemic, while the Total Capital Ratio of 15.298% was also well above the revised requirement of 13%.

The Bank’s interest margin improved marginally to 3.52% for the quarter from 3.51% at end December 2019 but was lower than the 3.68% reported for the corresponding quarter of the previous year. Return on assets (before tax) and return on equity reduced to 1.48% and 11.16% respectively from 1.66% and 13.54% at the end of 2019. The Bank’s net assets value per share stood at Rs 130.35 at the end of 1Q 2020, with an improvement of 0.58% since the end of 2019.

As a group, Commercial Bank of Ceylon PLC, its subsidiaries and associates reported profit before tax of Rs 5.438 billion, an improvement of 8.35% and profit after tax of Rs 3.814 billion, reflecting growth of 19.54%.

The first Sri Lankan Bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for nine years consecutively, Commercial Bank is celebrating its 100th anniversary this year. The Bank, which won more than 50 international and local awards in 2019, operates a network of 268 branches and 865 ATMs in Sri Lanka.

Commercial Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Representative Office in Yangon and a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.