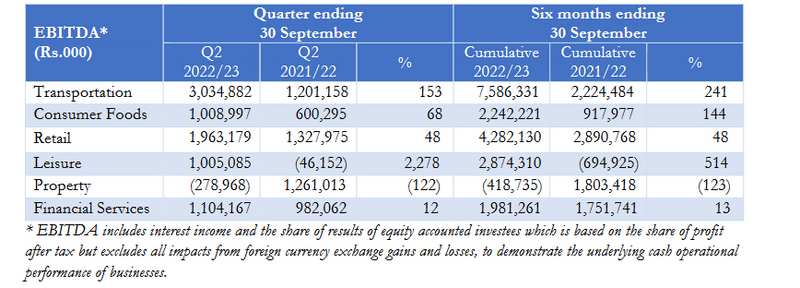

“JKH records EBITDA growth of 45% to Rs.9.29 billion in Q2”

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

- Group EBITDA recorded a notable improvement to Rs.9.29 billion during the quarter under review, which is an increase of 45 per cent against the comparative period of last year [2021/22 Q2: Rs.6.41 billion], demonstrating the strong underlying cash operational performance of the Group.

- While the second quarter of the previous year was partially disrupted on account of the lockdowns due to the pandemic, the overall operating indicators in most businesses demonstrated activity at pre-pandemic levels.

- With the exception of the Property industry group, the Group’s businesses recorded strong growth in EBITDA, compared to the second quarter of the previous year, on the back of a continued recovery momentum.

- Group PBT recorded a decline of 10 per cent to Rs.2.56 billion in the quarter under review, mainly on account of the second quarter of the previous year including revenue and profit recognition from the handover of the residential apartment units at ‘Cinnamon Life’, and the higher finance expenses due to the significant increase in interest rates on working capital facilities, particularly in the Leisure and Retail industry groups. Further, the PBT of the Holding Company was impacted by the translation impact of the IFC loan interest payment and the notional non-cash interest charged on the convertible debentures issued to HWIC Asia Fund (HWIC) in August 2022, in line with the accounting treatment, due to significant difference between the market interest rates and the three per cent interest accrued on the instrument.

- In August 2022, the Government gazetted regulations under the Casino Business (Regulation) Act of 2010 to formalise the process of issuing of licences and monitoring of operations for casinos in Sri Lanka. With the regularising of Gaming, the Group will proceed with finalising arrangements with prospective gaming operators to operate at ‘Cinnamon Life’. Similar to the experience with Integrated Resorts in other Asian countries, ‘Cinnamon Life’ has the potential to transform Colombo as a destination for leisure and entertainment and lead to significant foreign exchange earnings for the country.

- The profitability of the Transportation industry group recorded an increase driven by the Group’s Bunkering business, which recorded higher margins, and the Group’s Ports and Shipping business, where both businesses benefitted from the translation impact due to the depreciation of the Rupee against the previous year.

- The Leisure industry group recorded a continued turnaround in performance primarily driven by the Maldivian Resorts segment, supported by higher occupancy.

- The Consumer Foods industry group continued its recovery momentum with the Beverages and Frozen Confectionery businesses recording growth in volumes.

- The performance of the Supermarket business was driven by growth in same store sales through a combination of higher basket values on account of inflation and an increase in customer footfall.

- The Property industry group recorded a decline in profitability as the second quarter of the previous year included revenue and profit recognition from the handover of the residential apartment units at ‘Cinnamon Life’. The recognition of revenue of all units sold at ‘Cinnamon Life’ up to 31 March 2022 was recorded across 2021/22.

- The Insurance business recorded a growth in gross written premiums whilst Nations Trust Bank PLC recorded an increase in net interest margins and a reduction in costs.

- As announced to the Colombo Stock Exchange, the Company concluded the issuance of an unlisted, unsecured, LKR denominated convertible debentures amounting to Rs.27.06 billion, through a private placement to HWIC, a subsidiary of Fairfax, Canada. The coupon interest payable on the debenture is at three per cent per annum.

- In a significant step towards strengthening Diversity, Equity, and Inclusion (DE&I), the Group introduced an equal one hundred days of maternity and paternity days as parental leave at the birth or adoption of a child.

- In light of the current socio-economic crisis in Sri Lanka and hardships faced by people in the country, the Group initiated a multi pronged crisis response programme in selected communities to address the areas of food security and the education of children and youth.

- The Group’s carbon footprint per million rupees of revenue decreased by 29 per cent to 0.37 MT while the water withdrawal per million rupees of revenue decreased by 36 per cent to 7.10 cubic meters.