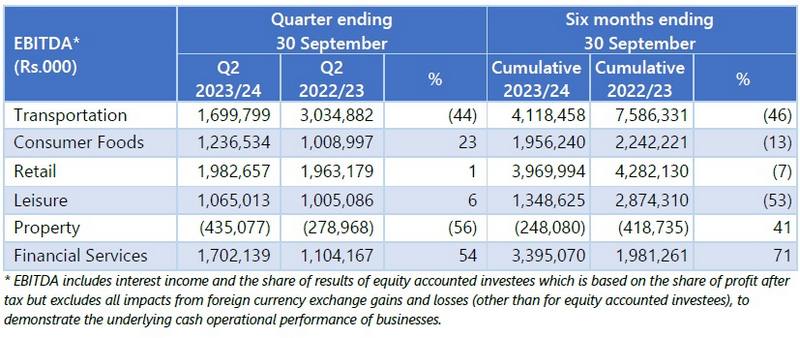

“JKH records EBITDA of Rs.8.06 billion in Q2 2023/24”

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

- During the quarter under review, the Group’s businesses, except for Transportation and Property, recorded growth in profitability.

- Group EBITDA at Rs.8.06 billion in the second quarter of 2023/24 is a decrease of 13% against Group EBITDA of Rs.9.29 billion recorded in the corresponding period of the previous financial year, mainly due to the lower EBITDA in the Transportation industry group. In the second quarter of the previous year, the Group’s Bunkering business recorded a substantial increase in profitability in its core ship bunkering operations driven by higher margins on account of the significant increase in global fuel oil prices.

- The functional reporting currency of Waterfront Properties (Private) Limited (WPL), the project company of the Cinnamon Life Integrated Resort, was changed from US Dollars (USD) to Sri Lankan Rupees (LKR) given the impending transition of the project from construction to an operational business next year. The depreciation of the LKR against the USD post-transition resulted in a non-cash exchange loss of Rs.2.14 billion on the USD 225 million term loan facility at WPL, which is recognised under Finance Cost in the Leisure industry group.

- Excluding the impact of the abovementioned exchange loss recorded on the USD 225 million term loan facility, Group PBT stood at Rs.1.99 billion, a decrease of 23% against the second quarter of 2022/23. PBT was further impacted by the notional non-cash interest charged on the convertible debentures issued to HWIC Asia Fund (HWIC) in August 2022, amounting to approximately Rs.800 million compared to approximately Rs.460 million in the second quarter of the last year.

- Further to the ongoing discussions with prospective gaming operators, WPL entered into a Memorandum of Understanding (MOU) with a leading international gaming operator. This MOU consists of the framework for investing into and operating of a casino at the Cinnamon Life Integrated Resort as well as the commercial framework between the parties. As originally envisaged, WPL will lease out space at the Cinnamon Life Integrated Resort for the operation of the casino. On finalising details of the fit-out and equipping costs and conclusion of the lease agreement, a detailed disclosure will be made.

- The groundwork on the West Container Terminal (WCT-1) at the Port of Colombo is progressing well with all construction work relating to the first phase of the project (800 meters of quay length) being awarded.

- In line with expectations and actions undertaken by the businesses, both the Beverages and Frozen Confectionery businesses recorded an improvement in margins on account of declining raw material prices together with the stabilisation of the Rupee.

- The Supermarket business recorded a strong performance in revenue during the quarter, with same store sales recording encouraging growth of 10%, driven by customer footfall growth of 11%. The sustained increase in footfall is encouraging as it demonstrates the continued potential for higher penetration of certain customer segments.

- Leisure recorded an increase in profitability driven by a strong recovery in the Sri Lankan Leisure businesses, particularly the Colombo Hotels segment.

- John Keells Properties launched its latest residential project, ‘Viman’, located in the heart of Ja-Ela, a suburban area in close proximity to Colombo. The preliminary sales interest for the project has been encouraging and construction of the first phase is expected to commence next year.

- Nations Trust Bank PLC recorded a strong growth in profitability driven by net interest income through proactive asset liability management. Union Assurance PLC recorded encouraging double-digit growth in gross written premiums, driven by renewal premiums, and higher yields on investments.

- The Group’s carbon footprint per million rupees of revenue increased by 19% to 0.44 MT while the water withdrawal per million rupees of revenue increased by 30% to 9.25 cubic meters, mainly due to the decline in Group revenue in the second quarter compared to the corresponding quarter of the previous year.