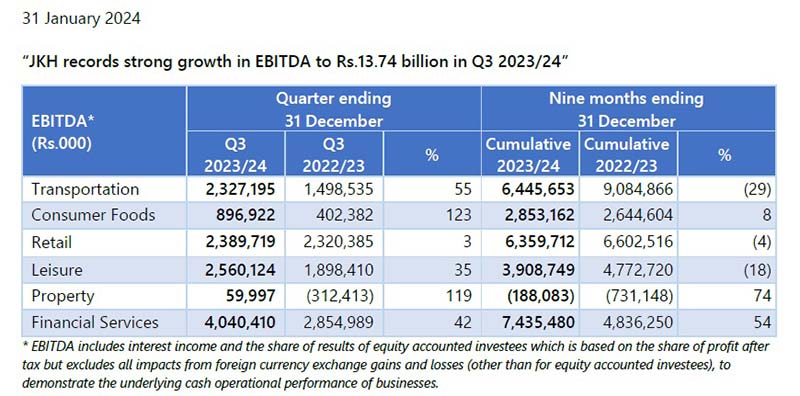

“JKH records strong growth in EBITDA to Rs.13.74 billion in Q3 2023/24”

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

- During the quarter under review, the Group reported a strong performance with all industry groups recording a growth in profits.

- Group earnings before interest expense, tax, depreciation and amortisation (EBITDA) at Rs.13.74 billion in the third quarter of the financial year 2023/24 is a 32% increase against the Group EBITDA of Rs.10.41 billion recorded in the previous financial year, particularly in the Consumer Foods and Insurance businesses.

- Group profit before tax (PBT) at Rs.5.49 billion in the quarter under review is an increase of 88% against the PBT of Rs.2.91 billion recorded in the third quarter of 2022/23. Group PBT recorded an increase due to the increase in EBITDA together with the gradual easing of interest rates and normalised working capital requirements, particularly in the Consumer Foods and Supermarket businesses.

- The groundwork on the West Container Terminal (WCT-1) at the Port of Colombo is progressing well, with all construction work relating to the first phase of the project (800 meters of quay length) being awarded, including the commissioning of the first batch of operating equipment. The U.S. International Development Finance Corporation (DFC) announced, in November 2023, that it has committed to finance the development of the WCT-1 project through a long-term loan facility of USD 553 million.

- Further to the entering of the Memorandum of Understanding (MOU) with the selected international gaming operator, a significant amount of advanced design work, engineering and other construction and planning related aspects have been completed. The significant groundwork completed by both parties will enable, and pave the way, for a timely and rapid completion of the fit-out of the gaming space, once commenced. The parties are now working on the final stages of establishing the corporate and administrative framework which will enable commencement of fit-out at the earliest.

- The Consumer Foods industry group recorded a significant increase in EBITDA on account of both the Beverages and the Frozen Confectionery businesses, driven by improved margins, as input costs have normalised from the previous peaks, and reductions in overhead costs.

- The Supermarket business recorded a strong performance in revenue during the quarter, with same store sales recording an encouraging growth of 11%, driven by growth in customer footfall of 16%. Despite the revenue growth, EBITDA remained flat primarily on account of electricity cost increases.

- In November 2023, the Company partnered with BYD Company Limited, the world’s leading manufacturer of new energy vehicles (NEV), to provide cutting-edge and eco-friendly vehicles to the Sri Lankan market. This new business will operate under the Retail industry group considering its alignment with the business and potential synergies.

- The Sri Lankan Leisure businesses continued to record an improvement in performance, with an increase in occupancies and room rates across properties, on the back of a sustained recovery in tourist arrivals to the country. The Colombo Hotels segment continued its strong performance in restaurant operations whilst recording an increase in the number of events and banquets.

- The renewed sales momentum at ‘TRI-ZEN’ is encouraging and shows that the market is beginning to adjust to the new price levels in the industry. The preliminary sales interest for the ‘Viman’ project has been very encouraging with over 70 SPAs signed to date out of a total of 114 units in the first phase of the project.

- The profitability of Union Assurance PLC (UA) was driven by the life insurance surplus which recorded an increase against the corresponding period of the previous year. UA recorded encouraging double-digit growth in gross written premiums, driven by renewal premiums, and higher yields on investments. NTB recorded a growth in profitability aided by loan growth, lower impairments and increased trading and fee income.

- The Group’s carbon footprint per million rupees of revenue increased by 9% to 0.42 MT while the water withdrawal per million rupees of revenue increased by 0.3% to 6.84 cubic meters.