Teejay posts revenue growth of 24% in volatile 2016-17

Achieves net profit of Rs 2 billion despite huge increases in raw material costs

Teejay Lanka PLC (formerly Textured Jersey), the Sri Lanka headquartered world-class knit fabric solutions provider, has reported revenue of Rs 22.2 billion at Group level and net profit of Rs 2.0 billion for the 12 months ending 31st March 2017, despite substantial increases in raw material costs during much of the year.

In financial statements filed with the Colombo Stock Exchange (CSE) this week, the Group said its achievement of 24.4 per cent top line growth and its success in keeping the reduction in net profit to 9.8 per cent were attributable to its focus during a year of volatility, on capacity utilisation, expanded operations, stringent cost controlsand improved production efficiencies.

Prices of cotton yarn, Teejay’s most significant direct cost component, escalated by 20 per centduring nine of the 12 months reviewed,exerting pressure on gross profit margins, which reduced by 39.7 per cent in the fourth quarter alone, the company said. Despite this challenge, the Group achieved revenue of Rs 5.8 billion (up 5.7 per cent) and net profit of Rs 494 million in that quarter.

Additionally, acceptance of higher order volumes at lower margins in preparation for growth, product mix changes, shifts and changes in end customer strategy, and a temporary countrywide stock outage in coal during the third quarter, which resulted in energy costs rising, all contributed to the Group’s final annual result.

Atstandalone company level, Teejay Lanka posted turnover growth of 11.2 per cent to Rs 15.7 billion for the full year and net profit of Rs. 1.5 billion, reflecting an increase of 1.2 per cent over the preceding year.

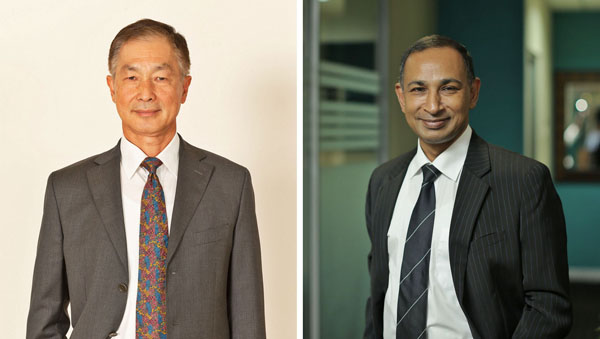

“This performance is a relatively strong achievement in the context of the volatility in the yarn market,” Teejay Lanka PLC Chairman Bill Lam said.“Improved production efficiencies, stringent overhead controls and process streamlining will play a key role in the new financial year, coupled with the pursuit of a wider customer strategy.”

CEO of Teejay, Sriyan de Silva Wijeyeratne disclosed that Teejay is investing approximately US$ 15 million in capacity expansion in India in preparation for future growth through GSP and other initiatives, and that capacity will be available in the second quarter of the current financial year. “Cotton price volatility is expected to ease out by around the end of Q2, and at this point we welcome the latest news currently coming in on the GSP,” he stated. “The company is cautiously optimistic on its expansions in India and its new ventures into Synthetics, which has so far met with good customer response.”

The Teejay Group has carried through a strong balance sheet from the fourth quarter of 2016-17 with a net cash balance of Rs 2.7 billion. Consolidated Earnings per Share (EPS) for the Group stood at Rs 2.80 for the year.

Teejay is listed on the Colombo Stock Exchange and supplies to some of the best international brands across the world. The Company was named among the Forbes “Best under a Billion in Asia.”The Group is backed through shareholding by two leading industrialists – Pacific Textiles, a Hong Kong based company with one of the largest manufacturing facilities in China, and Brandix Lanka, which is Sri Lanka’s largest apparel exporter and partners Teejay as a strategic link in the supply chain.