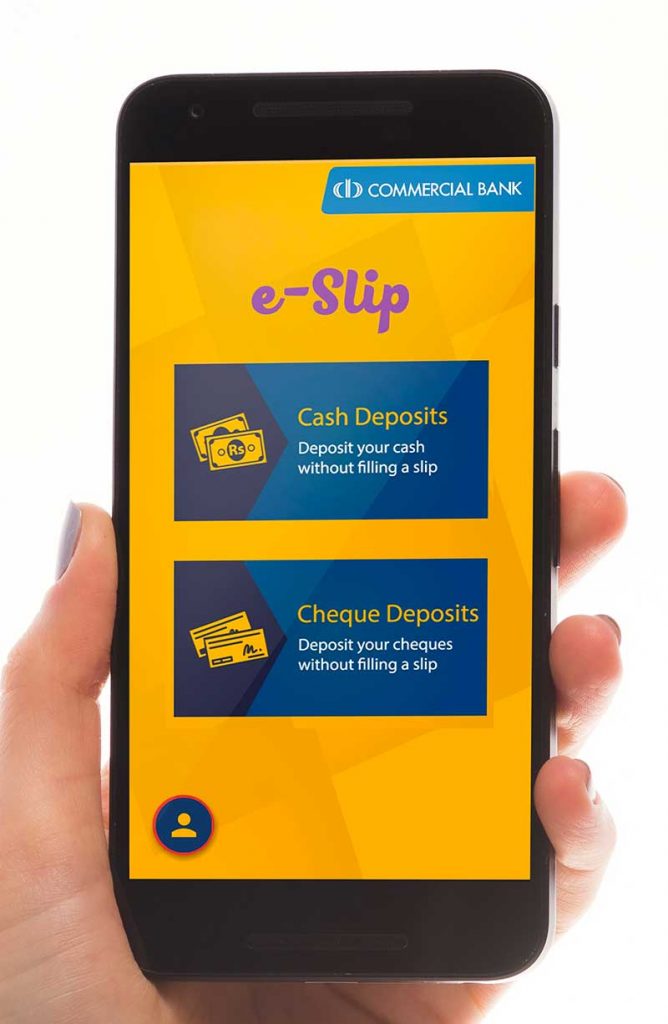

ComBank introduces ‘e-slips’ mobile app for paperless cash and cheque deposits

Cash and cheques can now be deposited paper-free into current or savings accounts at Commercial Bank of Ceylon, following the launch of an innovative new app that generates ‘e-slips.’

This is the first app to be launched in Sri Lanka for cheque deposits, and significantly enhances customer convenience in the new normal environment, the Bank said.

The Commercial Bank e-Slip app enables customers to create electronic deposits on their smart phones in respect of cash and cheque deposits.

This app can be downloaded free of charge from the App Store or Google Play Store. The app is operable in English, Sinhala and Tamil and is compatible with both Android and iOS powered smartphones and devices. The Bank said anyone with the app can now support its green initiative by eliminating the paper and envelopes used in the standard deposit process.

Catering to a clientele that is environment-conscious, the app also helps save time, as customers can digitally fill their e-slips on the app for cash deposits or capture an image of the cheque after crossing the reverse with the words ‘Com e-Cheque’ for cheque deposits before arriving at the Bank. Depositors can also conveniently maintain a record of all their deposits in one place on the app, without the hassle of filing the receipts of their bank slips.

After downloading the ‘ComBank e-Slips’ app users simply self-register themselves, activate their app after receiving a one-time-password (OTP), and begin their slip-less deposits. Whenever an e-slip is created the app generates a QR code which can be shown at the bank counter when the cash is handed over. After making a cheque deposit via the e-Cheque app, the customer or his agent is required to deposit the original cheque in a designated ‘Drop Box’ at the nearest branch within three days. The customer’s app will be updated with the status of the cheque when the bank submits it for clearing.

The e-Slips app provides users the facility of verifying the account numbers of recipients before making deposits, and categorising each deposit according to purpose for convenient tracking and retrieval. Each completed transaction is acknowledged with an e-receipt.

Customers can only deposit one cheque per transaction via the e-Cheque app at a time, although any number of transactions can be submitted in a day, the Bank said. Cheques up to the value of Rs 2 million can be deposited through the app. Customers are also required to state the purpose of the transaction in the app when depositing cheques with a value of over Rs 200,000 to a Savings Account or above Rs 500,000 to a Current Account.

When cheques are deposited via the app for utility bill payments, for Commercial Bank Credit Card payments or to accounts with special narrations, it is mandatory to state such details on the reverse of the cheque prior to scanning it. The depositor is also required to type in the narration in the space provided in the app for it to be processed.

The e-receipt generated after a successful transaction will include a QR code and a reference number, and will be saved in the app with the image of the relevant cheque for a period of three months.

In 2019, Commercial Bank was presented the ‘Excellent Green Commitment Award’ for the Banking Sector by the Green Building Council of Sri Lanka (GBCSL), the country’s leading authority on implementing green concepts and green building practices, in acknowledgement of the Bank’s progress in eco-friendly operations.

The Bank also broke new ground in 2016 when it became the first bank in Sri Lanka to offer customers an e-Passbook that provides access to details of savings, current, personal and business foreign currency accounts and Credit Card transactions on Android and iOS powered mobile devices.

The first Sri Lankan Bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 10 years consecutively, Commercial Bank is celebrating its 100th anniversary this year. The Bank, which won more than 50 international and local awards in 2019, operates a network of 268 branches and 880 ATMs in Sri Lanka.

Commercial Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Representative Office in Yangon and a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.