‘Flash’ Digital Banking app links with global climate impact calculation leader Doconomy

ComBank to upgrade to latest version of Åland Index to expand scope of app’s ‘Save the Environment’ feature

The Commercial Bank of Ceylon has announced a partnership with Doconomy of Sweden, a global leader in impact-tech solutions, to further develop the effectiveness of the Carbon Footprint Calculator in the ‘Flash’ Digital Banking app developed and deployed in Sri Lanka by the Bank.

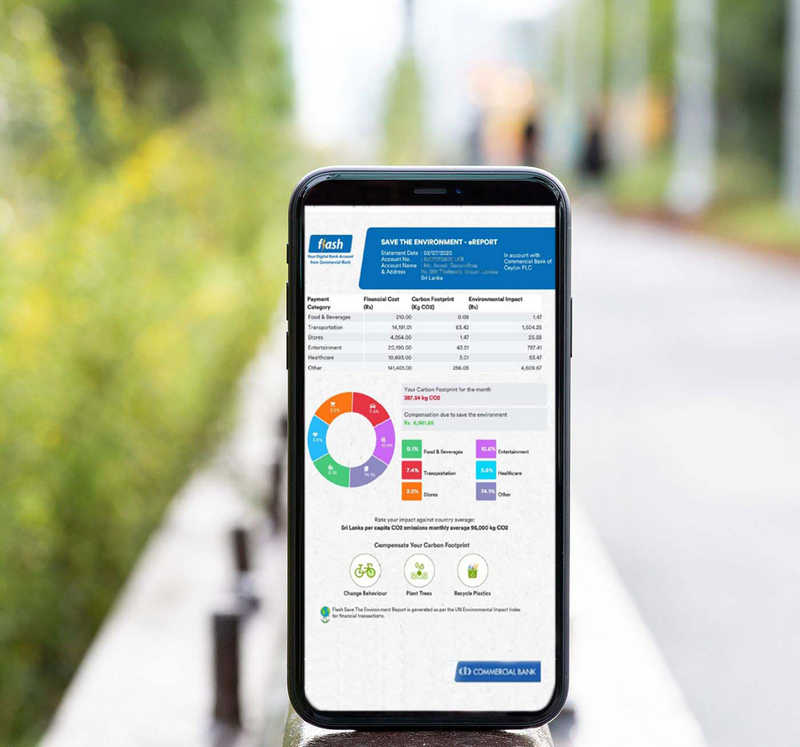

Doconomy owns the Åland Index, the world’s first e-Environmental Impact Report originally developed by Finland’s Åland Bank. Version 1 of the Åland Index powers the existing ‘Save the Environment’ feature on Flash, and the Bank said its partnership with the index’s new owner would enable the Flash app to upgrade to the latest version, and expand its scope.

By partnering with Doconomy and gaining access to the upgraded API of the index, Commercial Bank has joined the company of pioneering banks in the world to drive carbon footprint reduction among its customers. Furthermore, the integration of the updated index enables the Flash app to capture not just the carbon footprint of immediate service providers, but also of the entire value chain of the goods or services purchased by its users.

Commenting on the partnership with Doconomy, Commercial Bank Managing Director Mr S. Renganathan said: “As Sri Lanka’s first carbon neutral bank, the Commercial Bank has assumed a leadership role in increasing consciousness of the need, not just for organisations but individuals, to be concerned about the environmental impact of their consumption. With the ‘Save the Environment’ feature in the Flash app, we invited our customers to join in our mission to reduce their carbon footprint and contribute towards a greener future.”

“Doconomy’s endorsement of the Flash app’s efficient use of the Åland Index is a great achievement, more so because it tells us that we are on the right track in helping to mitigate the effects of the climate crisis. The partnership holds us to industry benchmark standards of carbon footprint calculations and positions the Flash app’s ‘Save the Environment’ feature among the global leaders in this aspect.”

The Åland Index is a cloud-based service for climate impact calculations and is the leading index solution for CO2 emission calculations for payments and financial transactions. The Commercial Bank of Ceylon was the first and only bank in Sri Lanka to adopt this free source index version 1.0 when it upgraded the Flash app last year with the ‘Save the Environment’ feature that not only enabled users to compute the environmental impact of their spending but raised awareness about their everyday environmental impact.

Doconomy entered into a Memorandum of Understanding (MoU) with the Commercial Bank of Ceylon to offer the latest version of the index. To fulfill the objectives of the MoU, the two parties intend mutual collaboration on CO2 footprint follow-up of customer transactions, tracking of trends, educational initiatives and communication.

The winner of the award for the ‘Digital Banking Initiative of the Year’ in Sri Lanka at the 2021 Asian Banking and Finance (ABF) awards, Flash is a comprehensive digital banking app that provides financial services required to manage the lifestyle of a customer across aspects such as daily living and utility expenses, budgeting, saving, financing, eCommerce, environmental awareness, and investments.

Founded in Sweden in 2018, Doconomy is a world-leading provider of applied impact solutions. Doconomy seeks to future-proof life on planet earth by empowering individuals and corporations to take responsibility for their environmental footprint. Firmly believing that the climate crisis can only be solved as a collective, Doconomy is also a partner of the United Nations Framework Convention on Climate Change (UNFCCC), Mastercard, S&P Trucost, the World Wildlife Fund (WWF), and Parley for the Oceans.

The first Sri Lankan bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 11 years consecutively, Commercial Bank operates a network of 268 branches and 931 automated machines in Sri Lanka. The Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake